For young professionals, budgeting feels like math and sacrifice — but it’s more importantly a tool of behavior. By shaping habits, budgets reduce friction between intention and action, helping you save, invest, and avoid impulse decisions. Early-career investors benefit by allocating small, consistent amounts to diversified investments — a budgeting plan makes that reliable.

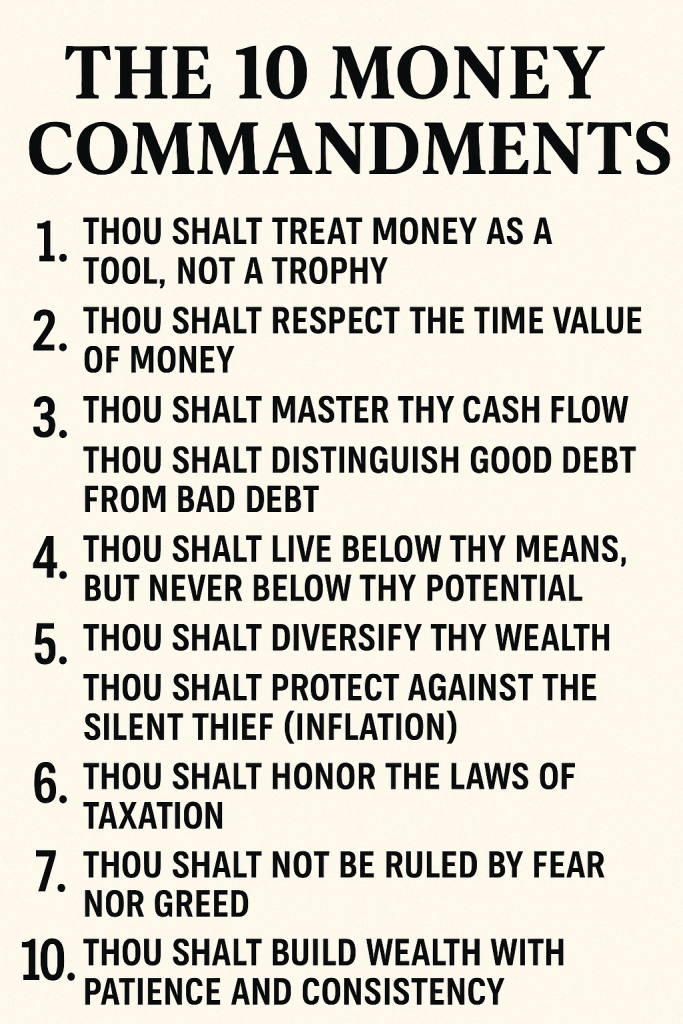

Understand The Psychology. Behavioral finance shows we’re influenced by present bias, loss aversion, and mental accounting. A practical budget uses these tendencies to your advantage:

Automate Savings and Investing

- Set small, measurable goals and public commitment devices to harness social and loss-aversion effects.

- to bypass temptation and make future-oriented choices automatic.

Strategic Budgeting Techniques

- Use rules-of-thumb (50/30/20) or purpose-driven buckets to simplify decisions and reduce decision fatigue.

- another similar rule its the (70/20/10) Rule, 70% for living expenses (housing, food, transportation).20% for savings or debt repayment. 10% for giving or investing in yourself (charity, courses, skills).

- 80/20 Rule (Pareto Principle for Money), 80% of financial results come from 20% of actions. Focus on the few money habits—budgeting, debt repayment, investing—that have the biggest long-term impact.

- 30% Housing Rule, Keep housing costs (rent or mortgage + utilities) under 30% of your gross income to maintain balance for other priorities.

- 1% Rule of Purchases, For any “want” over $100, wait one full day for every $100 it costs (e.g., wait 3 days before buying a $300 item). This prevents impulse spending.

- 3-Month Emergency Fund Rule Save at least 3 months of essential expenses in a high-interest savings account (HISA) to cover job loss or emergencies. Work up to 6 months for extra security.

Track and iterate. Review monthly, adjust categories, and celebrate milestones to reinforce positive behaviors. Treat your budget as an experiment: measure what reduces overspending and increases contributions to an emergency fund and long-term investments. Even modest automatic increases after raises accelerate progress through compounding and habit reinforcement and resilience.

Closing takeaway: Budgeting is less about restriction and more about designing an environment where good financial behavior happens automatically. Use automation, simple rules, and behavioral nudges to turn intentions into wealth-building habits.

Russ Adams